south san francisco sales tax rate 2020

About 2340 Donegal Avenue South San Francisco CA 94080. Citys sewer service charge rate.

States With Highest And Lowest Sales Tax Rates

County and is situated 19 miles south of San Francisco and 30 miles north of San Jose.

. The San Bruno sales tax rate is 05. The minimum combined 2022 sales tax rate for San Bruno California is 988. The County sales tax rate is 025.

305 Dna Way South San Francisco CA 94080. The December 2020 total local sales tax. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

The California sales tax rate is currently 6. More about San Mateo County Property Taxes. San Francisco CA Sales Tax Rate.

The south san francisco california general sales tax rate is 6. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. Ad Lookup Sales Tax Rates For Free.

1788 rows California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. Principal Sales Tax Producers 2020 2020. California Sales Tax Rates 2020 - Real Estate Apartment Mortgages Informations.

The South San Francisco California sales tax is 750 the same as the California state sales tax. The minimum combined 2022 sales tax rate for South San Francisco California is 988. This is the total of state county and city sales tax rates.

For tax rates in other cities see. The current total local sales tax rate in San Francisco CA is 8625. The San Francisco County Sales Tax is collected by the merchant on all.

The County sales tax rate is 025. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The current Conference Center Tax is 250 per room night.

There is no applicable city tax. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. This is the total of state county and city sales tax rates.

The expiration date of the new tax is June 30 2031. Collection Procedures for Transient. Discover California Sales Tax Rates 2020 for getting more useful information about real estate apartment mortgages near you.

715 AC MOL PARCEL 1 PARCEL MAP VOL 7871-72. The first sales tax ever proposed to explicitly benefit South San Francisco seems set to soon be going into effect as initial results from the San Mateo County Elections Office. The current total local sales tax rate in South San Francisco CA is 9875.

Assessment History for 1427 Mission Road South San Francisco. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The South San Francisco California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in South San Francisco California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within South San Francisco California.

You can print a 9875 sales tax table here. Y-G PLAN HOME NESTLED IN THE WESTBOROUGH AREA IN SOUTH SAN FRANCISCO. The December 2020 total local sales tax rate was 9750.

Look up the current sales and use tax rate by address. A No vote is a vote against increasing the TOT rate and would maintain the current TOT rate of 10. The current Transient Occupancy Tax rate is 14.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. ADDED ADU DOWNSTAIRS FOR ADDED INCOME. Heres the assessment property tax history for 1427 Mission Road South San Francisco including the evolution of the total tax rate and corresponding property tax.

Tax returns are required monthly for all hotels and motels operating in the city. San francisco kron several cities will have a sales use tax hike. What is the sales tax rate in South San Francisco California.

Health and Homelessness Parks and Streets Bond. Therefore there is no change to the tax rate. The California sales tax rate is currently 6.

Update to postal code abbreviation table effective may 2020 filing period. The South San Francisco sales tax rate is 05. 3 The city approved a new 050 percent tax SRTU consolidating the two existing 025 percent taxes SRGF and SATG by repealing these taxes and replacing them with a new 050 percent tax.

A subsequent 2 increase over the next two years would revise the TOT rate to 13 effective January 1 2020 and 14 effective January 1 2021. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The fiscal year ended June 30 2020 marked the second year of.

South san francisco lies north of san bruno and san francisco international airport in the colma creek valley south of daly city. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. San Franciscos 2020 Ballot will include five tax and bond measures which if passed would provide for a total of 980 million in debt service for bonds and tax increases of approximately 401 to 481 million annually each discussed in greater detail below.

The initial 2 increase would revise the Citys TOT rate from 10 to 12 effective January 1 2019. Interactive Tax Map Unlimited Use. South San Francisco CA Sales Tax Rate.

The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. LibraryVirtual - Asian Art Museum presents The Goddess. MOVE IN READY VERY INVITING HOME AND READY FOR YOUR FRIENDS OR FAMILY.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing.

Sales Tax On Saas A Checklist State By State Guide For Startups

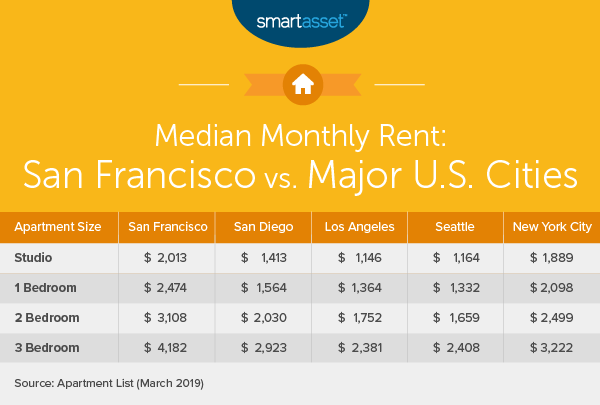

What Is The True Cost Of Living In San Francisco Smartasset

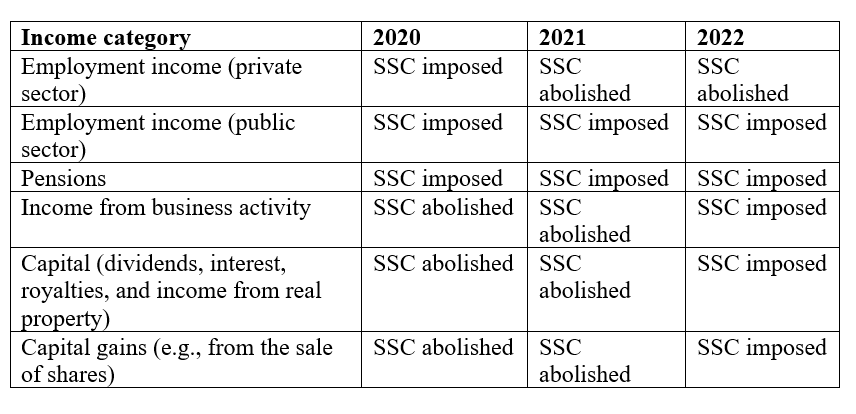

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Rates In Major Cities Tax Data Tax Foundation

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Prop K Sales Tax For Transportation And Homelessness Spur

States With Highest And Lowest Sales Tax Rates

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Sales Tax By State Is Saas Taxable Taxjar

What Is The Cost Of Living In San Francisco

Frequently Asked Questions City Of Redwood City

Food And Sales Tax 2020 In California Heather

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

Prop K Sales Tax For Transportation And Homelessness Spur